TOP COMMENTS FROM VIDEO BELOW

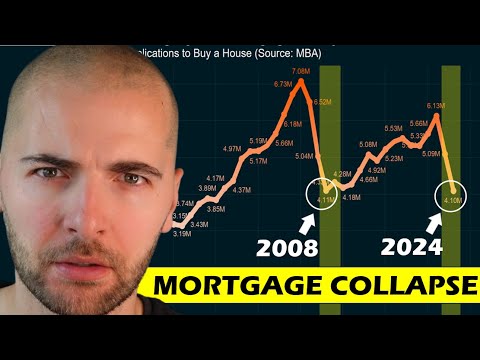

I predict a housing crash due to people buying homes over asking price, lacking equity if prices decline further. Foreclosure becomes likely if they can’t afford the house, and selling won’t yield profits. With anticipated layoffs and rising living costs, many individuals may face this situation.

Mortgage rates are currently at an all time high since 2000(24 years) and based on statistics on inflation, we might see that number skyrocket further, a 30-year fixed rate was only 5% this time last year, so do I just keep waiting for a housing crash before buying or redirect my focus to the equity market