TOP COMMENTS FROM VIDEO BELOW

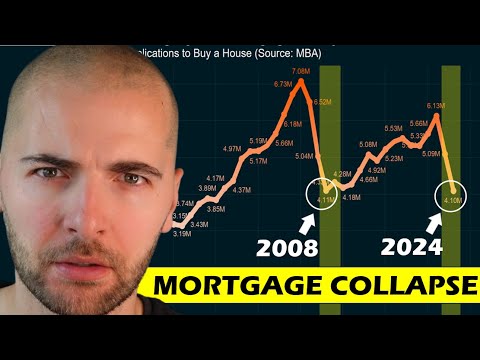

I predict a housing crash due to people buying homes over asking price, lacking equity if prices decline further. Foreclosure becomes likely if they can’t afford the house, and selling won’t yield profits. With anticipated layoffs and rising living costs, many individuals may face this situation.

Mortgage rates are currently at an all time high since 2000(24 years) and based on statistics on inflation, we might see that number skyrocket further, a 30-year fixed rate was only 5% this time last year, so do I just keep waiting for a housing crash before buying or redirect my focus to the equity market

This is happening because of dummycrat meddling in the economy, just like in the late 1970s and the 1990s (but it took until 2008 for the housing market to explode, but the dummycrats from Clinton, Frank the House fag, and senator Dobbs were the ones responsible for that mess). Now we have a stupid old senile poopypants lying bastard and his quack wife and their stupid brain dead robots pretending to be human beings doing the same stupid mistakes of the past. Sure proves the old saying, if you don’t learn from the mistakes of the past you’re doomed to repeat them.